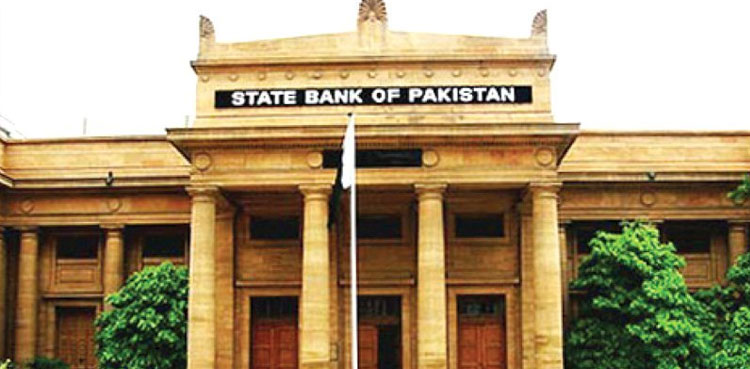

Karachi: The State Bank of Pakistan (SBP) has sold treasury bills worth Rs 434 billion, including 3-month, 6-month, and 12-month bills, ARY News reported.

According to reports, the central bank received bids totalling Rs1,701 billion from banks for these securities.

A reduction of 21 to 50 basis points was recorded in the yield on treasury bills. The yield on 3-month T-bills is now 11.78 percent, while 6-month bills offer a yield of 11.79 percent. The yield on 12-month treasury bills has been set at 11.8 percent.

This sale is part of SBP’s ongoing efforts to manage liquidity and stabilise the financial market.

Read More: Pakistan’s foreign exchange reserves lowest in region: Governor SBP

Earlier, governor of State Bank of Pakistan announced that country’s foreign exchange reserves are the lowest among regional countries when compared to their import bills.

Governor Jameel Ahmed made these remarks before the Senate Standing Committee on Finance, stating that inflation is expected to rise further in the last quarter of the current fiscal year and the first quarter of the next one. He also highlighted that Pakistan must meet $4.5 billion in external debt payments by July 2025.

Ahmed confirmed that a UAE safe deposit will be cleared on schedule this month. He added that for the first time in 20 years, the current account showed a surplus as of November in the ongoing fiscal year.

A reduction in the interest rate has lowered debt servicing costs from PKR 9.8 trillion to PKR 8.3 trillion. During the briefing, it was revealed that Pakistan banks pay around $800 million annually for ATM card and online transaction services. The committee suggested introducing a local payment card to reduce this burden.

The chairman of the committee warned that unless banks halt dollar payments for local services, legislation will be considered. He expressed concern over dollar shortages while billions are spent on card services.

from ARY NEWS https://ift.tt/ZlfEgec